Although every aspect of overseeing a small business can be challenging, financial management is often uniquely complex. Even though a basic understanding of financial management may bring an entrepreneur through the first stages of business development, a comprehensive understanding is eventually required. In the content below, we seek to provide a helpful small business bookkeeping guide for startups looking to pave the way to long-term success.

1. Bookkeeping is Critical for Business Success

Whether you’re launching a new business or managing day-to-day operations, bookkeeping plays a vital role in your long-term success. It’s more than just keeping records—bookkeeping helps you understand where your money is going, keep your business compliant, and make smarter financial decisions that support sustainable growth.

What is Bookkeeping?

Bookkeeping is the process of recording and organizing all financial transactions for your business. It involves tracking every dollar that goes in and out of your accounts, ensuring your financial records are accurate and up to date. While bookkeeping and accounting are often used interchangeably, they are different. Bookkeeping focuses on recording financial data, while accounting involves interpreting and analyzing that data.

Why Bookkeeping Is Important for Small Businesses

Bookkeeping provides the financial foundation for your business. It requires constant monitoring of the numbers, because accurate books help small business owners:

- Maintain compliance with taxes and regulations

- Track your profitability and cash flow

- Prepare for audits

- Make informed business decisions

Without proper bookkeeping, small business owners can find themselves unprepared during tax season or unaware of underlying financial problems. Inversely, a knowledgeable bookkeeper can analyze the data and spot potential financial challenges before they implode and, potentially, cripple a business. Additionally, data analysis also reveals areas of opportunity for business expansion or optimization.

2. Know the Lingo: Bookkeeping Terms to Understand

Bookkeeping lingo can feel like a foreign language to those with no background in accounting or finance. However, understanding basic bookkeeping terms will help you communicate with financial professionals and better understand your records.

Basic Bookkeeping Terms All Small Business Owners Should Know

- Asset: Any item owned by your business

- Accounts Payable: Money owed to suppliers or vendors

- Accounts Receivable: Money owed to your business by customers

- Chart of Accounts: A list of all accounts used to categorize financial transactions

- Debits & Credits: Entries that increase or decrease account balances depending on the account type

- Expense (or expenditure): Any transaction that your business pays for, such as rent, salaries, or marketing

- General Ledger: A complete record of all financial transactions

- Liability: Something your company owes money towards, like a business loan

- Profit: The total money your business “made” after subtracting expenses from revenue

- Revenue (or income): Income made from sales, but differs from profit

- Sale: Any transaction that produces cash for your business

3. Familiarize Yourself With Your Bookkeeping System

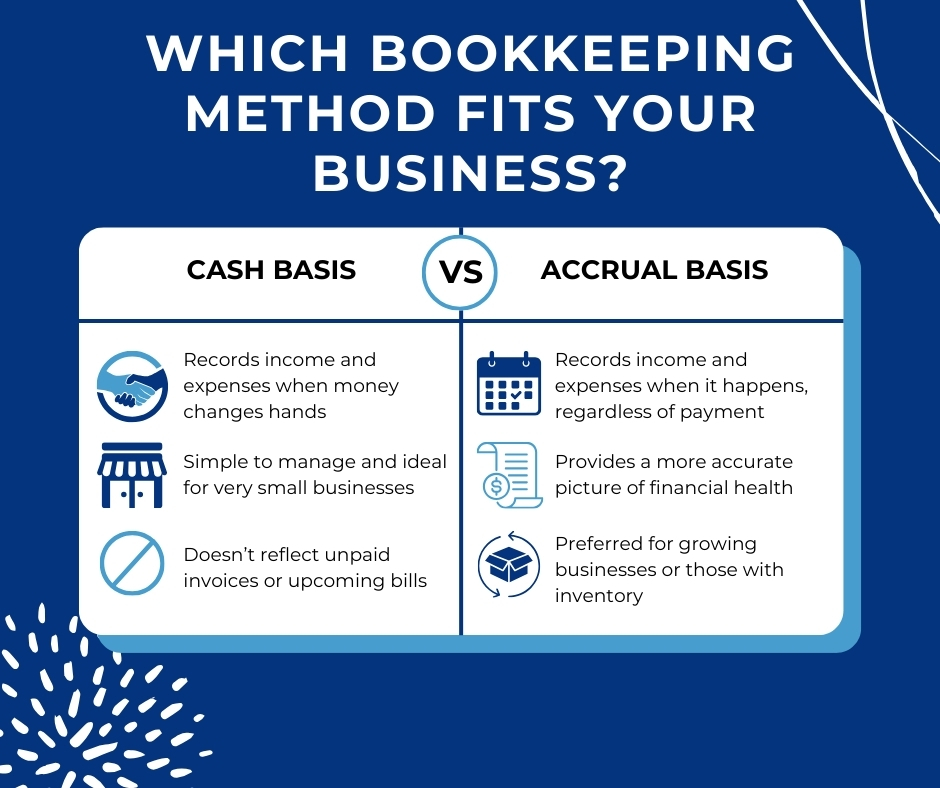

Businesses use two primary methods to document revenue and expenses and report to the IRS: cash basis or accrual. Depending on the proper method for your company, every other bookkeeping task is affected. Thus, selecting the proper type of accounting immediately is important.

Cash Basis Bookkeeping

With a cash basis system, you record income and expenses when money changes hands. It’s simple and offers a real-time snapshot of cash flow, making it ideal for sole proprietors and tiny businesses. However, it may not reflect outstanding invoices or upcoming expenses, which can lead to an incomplete picture of your financial health.

Accrual Basis Bookkeeping

With accrual basis bookkeeping, you record income when it’s earned and expenses when they are incurred, regardless of when money is exchanged. This method aligns revenue with the expenses incurred to earn it, giving a more accurate view of long-term profitability and financial performance. It’s generally preferred for growing businesses or those that carry inventory.

How to Choose

The cash method is easier to manage and often used by businesses that don’t carry inventory and operate on a mostly cash-in, cash-out basis. The accrual method is more complex but essential for businesses seeking to scale, get financing, or track financial trends over time.

Pro Tip: Consult with a bookkeeper or accountant before choosing your method—switching from cash to accrual (or vice versa) later can be a complicated process that may require IRS approval.

4. Understand the Three Most Important Financial Reports

Every small business owner should know how to read and interpret these essential financial reports:

Balance Sheet

Shows your business’s financial position at a specific point in time. It lists:

- Assets (what you own)

- Liabilities (what you owe)

- Equity (owner’s interest in the business)

A balance sheet helps you evaluate your business’s overall health and solvency.

Profit and Loss Statement (P&L)

Also called an Income Statement, this shows your business’s revenue, expenses, and profit over a specific period. It helps answer:

- Are we making money?

- What are our biggest expenses?

- Are sales improving over time?

Cash Flow Statement

Tracks the actual inflow and outflow of cash in your business. It shows whether your business has enough money to cover its bills. A business can be profitable on the P&L and still struggle if cash isn’t flowing properly.

These reports work together to give you a complete view of your financial situation—don’t ignore them!

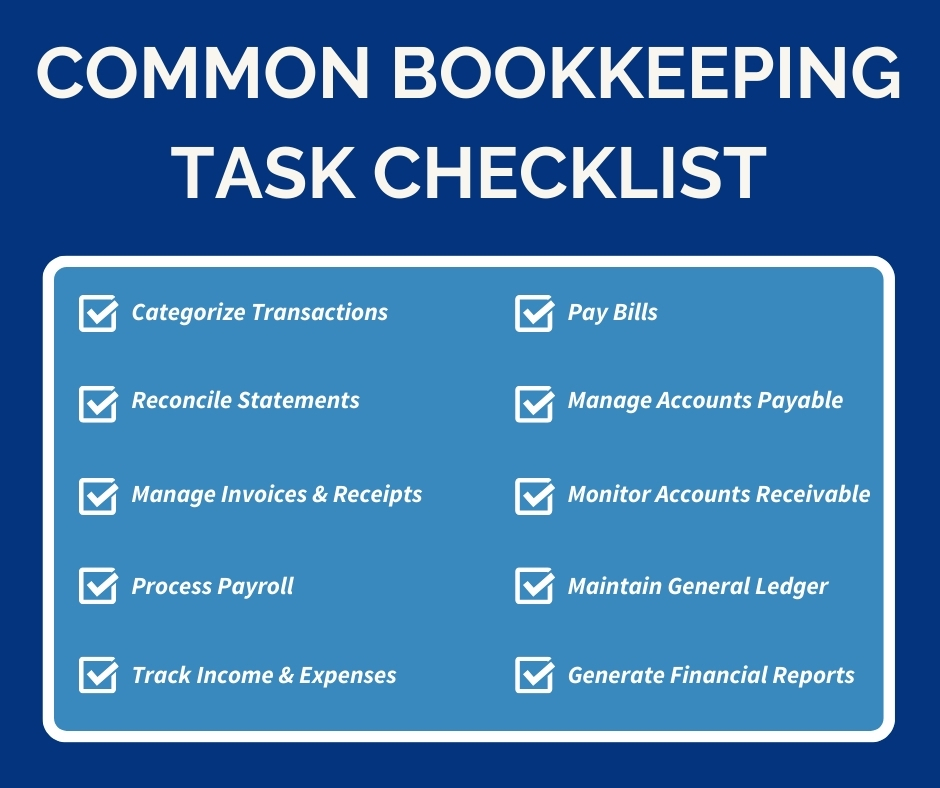

5. Learn How to Perform Common Bookkeeping Tasks

Small business bookkeeping involves a wide range of responsibilities that keep your financial records accurate, organized, and compliant.

Here are the core tasks every small business owner should be aware of:

- Categorizing Transactions: Assigning income and expenses to the appropriate accounts in your chart of accounts. This ensures accuracy in your financial reporting and helps you identify patterns over time.

- Reconciling Bank and Credit Card Statements: Comparing your internal records to your bank and credit card statements to ensure all transactions match. This helps catch errors, prevent fraud, and maintain financial accuracy.

- Managing Invoices and Receipts: Sending invoices to customers, recording incoming payments, and saving receipts for all business-related purchases. Good documentation is crucial for tax deductions and audits.

- Processing Payroll: Ensuring employees and contractors are paid accurately and on time, and withholding the appropriate taxes. Payroll compliance is essential to avoid penalties.

- Tracking Expenses and Income: Monitoring all incoming revenue and outgoing expenses. This helps you budget, control costs, and understand your profit margins.

- Paying Bills and Managing Accounts Payable: Keeping up with due dates and ensuring vendors and suppliers are paid promptly to maintain strong business relationships.

- Monitoring Accounts Receivable: Tracking outstanding customer payments and following up to collect overdue invoices. Timely collections improve your cash flow.

- Maintaining the General Ledger: Ensuring all transactions are accurately recorded in your general ledger, which serves as the master document for your books.

- Generating Financial Reports: Producing reports like the profit and loss statement, balance sheet, and cash flow statement to analyze your business’s financial performance.

Completing these tasks regularly keeps your finances on track and ensures you’re prepared for tax season, audits, or financial planning decisions.

6. Use the Right Tools

Many small business owners use accounting software to streamline bookkeeping. Popular options include:

- QuickBooks: Industry standard with robust features

- Xero: Cloud-based with strong integration options

- FreshBooks: User-friendly and ideal for service-based businesses

These tools can automate many routine tasks and provide real-time financial insights.

7. Know When to Ask for Help: DIY vs. Hiring a Bookkeeper

Doing your own bookkeeping can save money in the early stages of your business. However, as your business grows, outsourcing may become a better option. Professional bookkeepers ensure accuracy and compliance, free up your time, and offer valuable financial insights.

If bookkeeping starts taking time away from growing your business, it’s probably time to outsource your bookkeeping to an expert like Remote Quality Bookkeeping.

8. Establish Healthy Bookkeeping Habits Early

A strong bookkeeping routine isn’t just about record-keeping—it’s about building habits that support long-term business success. These best practices will help you stay organized and financially stable:

- Separate Personal and Business Finances: Open a dedicated business bank account from day one to avoid mixing expenses. It simplifies tax season and gives you a clear picture of your business performance.

- Build an Emergency Fund: Unexpected expenses or delayed payments can disrupt your cash flow. Setting aside a financial cushion helps you navigate tough times without panic.

- Create a Realistic Bookkeeping Schedule: Choose a cadence that works for you—weekly transaction tracking, monthly reviews, quarterly reconciliations—and block time in your calendar to stick to it.

- Minimize Debt When Possible: Paying with cash (or a debit account) keeps you honest about your spending and avoids unnecessary debt. Track every purchase to stay in control of your budget.

Bonus Tip: Meet More Than Your Bookkeeping Basics by Hiring Remote Quality Bookkeeping

At the beginning of business development, small business owners often tackle every role themselves. However, as the company grows in revenue, staff, and complexity, a professional is often required to manage business finances effectively. At the same time, we know small businesses often cannot afford a full-time bookkeeper.

At Remote Quality Bookkeeping, we provide remote bookkeeping services for small businesses poised to grow and succeed. Our team saves businesses time and headaches. If you are interested in professional financial assistance, please request a quote, schedule a free demonstration, or simply call us. We’re ready to work with you.