Companies have stringent policies regarding accounts receivable. Despite these policies, many business firms in the US have up to 24 percent unpaid invoices. Pending payments can cause much damage, such as missed investment opportunities, disrupted hiring, delayed purchases, or debt accumulation. If the problem continues, it can bring further challenges.

Invoice collection problems can also lead to bigger problems that affect a company’s performance and profitability. Consequently, it will miss the target revenue and ROI, which is only the tip of the iceberg. The first step to resolving issues is to identify them and have a competent and professional bookkeeper who can offer actionable solutions.

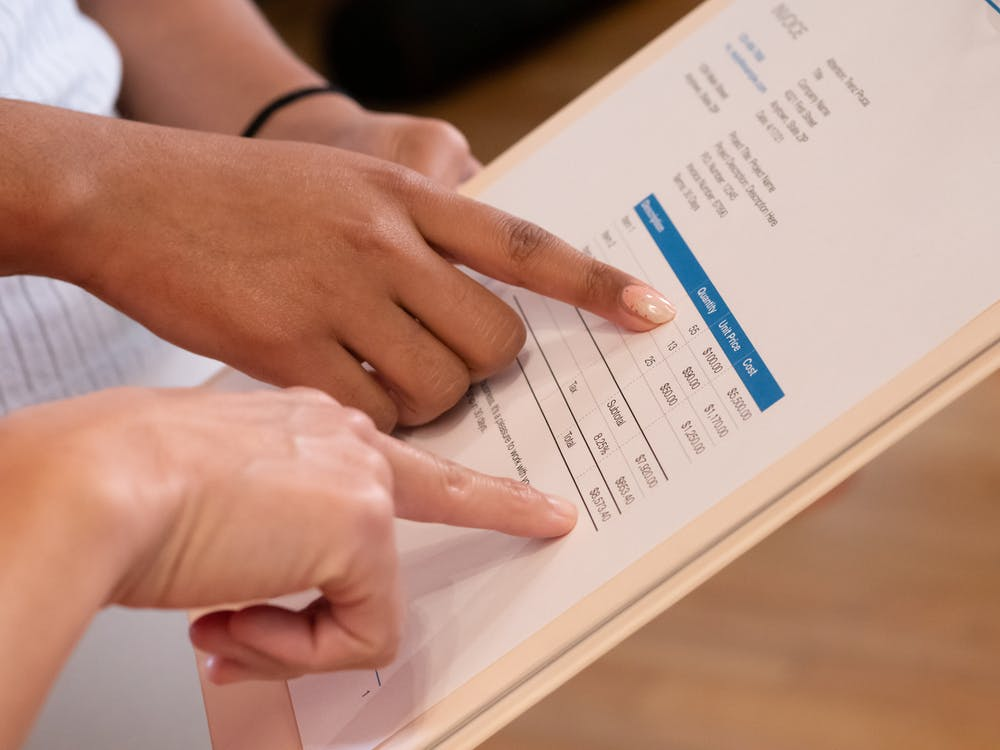

Here’s how are some common accounts receivable challenges and their solutions:

Common Accounts Receivable Challenges

Offering different payment modes like credit or COD for your customer base can cause accounts receivable challenges. In the long run, these problems can impact business performance and profit.

Late Payments

A common accounts receivable issue is late payments by the customers. Late payments can make cash flow management and capital investment difficult. You must know why the customers aren’t paying or why they’re deducting the invoice amount. If not, you wouldn’t be able to resolve this issue.

One way to prevent late payments is to communicate and interact with your customers and find answers as to why there has been a holdup. There may be a roadblock in the payment method or the online portal through which customers make payments.

Inorganization

Another issue is inorganized invoices that lead to errors and inaccurate payments. To manage the cash and accounts, hold your AR team accountable so you don’t face inefficient practices in the company. Complete transparency and accountability are crucial.

One way to resolve this issue is to cut out the paper and shift to digitalized invoices. This will reduce the chances of inaccurate or lost invoices in the AR process. Additionally, if you have too many ERPs, opt for a unified source to facilitate your AR team.

Regular AR audits can also help minimize these challenges and limit pending invoices and late payments.

AR Policies

As your customer base grows, your company must also update its policies. The lack of proper policies can result in management issues. Well-thought-out policies will help identify which customers are paying and which ones are causing delays.

One way to overcome this problem is to make sure that the management reviews the customers’ payment and credit process. Moreover, make sure you are transparent about your payment policies with your customers and have a robust backup strategy in case of a credit issue in the AR process.

If you’re having trouble keeping up with your company’s finances, you’ve come to the right place. At Remote Quality Bookkeeping, our specialized professionals can provide accurate and efficient bookkeeping services, so you don’t have to deal with late payments.

We also offer Forensic accounting, payroll outsourcing services, and cost-effective bookkeeping for franchise systems.

Dial 866-567-4258 for more questions, or start your free trial now!s